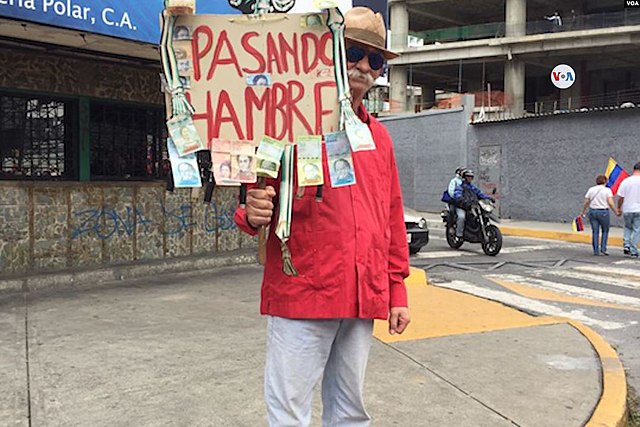

Due to hyperinflation, the Venezuelan currency (the bolívar) has lost much of its value.

So what do people do?

There are a few options.

One option is to start using a different currency. Many Venezuelans have opted for this. Many are now using the US dollar for transactions. But why use the dollar rather than any other currency?

People are betting that this dollarisation of the economy will lead to greater economic stability.

The US dollar is accepted internationally.

The US economy is large and diversified. The US dollar has been a relatively stable currency over a long period of time.

The American currency is frequently used for international transactions.

US dollars have high liquidity. They can cross international borders very quickly – either in the form of cash or digitally.

The US dollar tends to maintain its purchasing power.

It is often used as an alternate currency in Latin America.

In 2000 Ecuador even officially replaced its own currency, the sucre, with US dollars.

But the adoption of the Greenback also opens up an opportunity for counterfeit dollar bills.

According to insightcrime.org, the US dollar has been a de facto currency in Venezuela since about 2019.

It is estimated that it is used in around 45% of transactions.

With the economy deteriorating, there was a rise in the use of counterfeit bills in 2017.

In some cases counterfeiters have used the material of bolívar notes to create fake US dollars.

Counterfeiting new bills can involve chemical bleaching and printing.

Some use laser printing while others use silk-screen printing.

This has led to a kind of arms race with shop owners purchasing special machines to test the validity of bills handed to them.

It may seem a strange state of affairs – when there are multiple currencies operating within a single country. But this parallel market represents an attempt to find a stable alternative when the official currency no longer seems fit-for-purpose.

Another issue is that with the increased dollarisation of the economy, the Central Bank of Venezuela has even less control over how much money is available in the market. This means that any action that it takes in relation to the bolívar may not have the impact that it would like or expect.

There are also other options that can be employed in response to the bolívar’s loss of value but they are utilised on a smaller scale.

Some use a premodern form of exchange – old-fashioned bartering.

There is real immediacy to this method as one doesn’t even need a medium of exchange.

The scale of remittances – payments made from family members outside of the country to those inside the country – have been increasing strongly in Venezuela in recent years.

Traditionally, these remittances have been made via intermediaries such as Western Union. Transaction fees can be up to 7%.

People are also looking at cryptocurrencies as another alternative.

In 2018, the Venezuelan government even introduced its own cryptocurrency – the Petro.

On the one hand this move showed that the authorities were willing to explore different and emerging technologies.

However, many were skeptical about the platform.

Venezuela is not the first country whose residents have adopted the US dollar when their own currency can no longer be relied on.

Survival strategies in times of hyperinflation may in fact be quite consistent no matter which country one looks at.

From pre-modern forms such as bartering to the tried-and-tested adoption of US dollars – at the core of all of these methods is a search for economic stability.

Leave a comment